Tech Trails: Mapping the Journey of Online Money Transfer to Pakistan

Algorithms are what underpin online money transfer systems in order to make sure that transactions are processed efficiently and securely. These algorithms take care of everything from currency conversion to transaction validation, making sure that the money sent from one country gets where it was intended to go without any undue delays or errors. The efficiency of these algorithms has increased by using machine learning and artificial intelligence, which can predict and mitigate potential issues before they arise.

Encryption Protocols: Your Money is Safe

One of the most important things when it comes to online money transfer to Pakistan is security. Sophisticated methods of encryption serve to secure critical information against cyber threats.

Examples of encryption techniques that create secure environments for business transactions include Advanced Encryption Standard (AES) and Secure Sockets Layer (SSL), which are aimed at making it hard for unauthorized people to get hold of or change the information.

Real-Time Processing: Fast and Efficient

Arguably, real-time transaction processing is the most important advancement in online money transfer.

It thus applies to both remitters and beneficiaries who reduce waiting time so as to have a great overall user experience. Real-time processing is possible as a result of sophisticated software applications that are capable of handling huge numbers of transactions without compromising on speed or accuracy. These systems are constantly updated so as to meet the increasing demand for faster and more reliable services.

Blockchain: Revolutionizing Remittances

Blockchain technology has raised levels of openness and security in online money transfers. In using a decentralized ledger, blockchain ensures that all the transactions are registered as well as verified by multiple nodes thereby reducing fraud risks and errors. This technology may lower transaction costs while speeding up cross-border money transfers, making it a suitable choice for remitting funds to Pakistan.

Biometric Authentication: Boosting Security

Moreover, several platforms have recently adopted biometric authentication for greater security of online financial transactions.

These measures like finger print scanning or facial recognition contribute an additional level of safety through ensuring that cash senders are recognized only by their authorized individuals.In particular, this helps prevent identity theft and unauthorized access making online transfers more secure than ever before.

Challenges and Opportunities

Nonetheless, there are many challenges facing the industry concerned with online money transfer despite all these accomplishments.

Regulation environment is one such challenge that varies widely from country to country. Hence, such a situation can lead to delays in processing transactions due to difficulties associated with complying with them. However, these challenges also create room for innovation. New ways are being conceived through technology to address the concerns. For example, the use of artificial intelligence in detecting and preventing fraud has become increasingly popular. Furthermore, there is an increasing focus on improving user interfaces and making online transfer platforms accessible to a wider audience.

Ultimate 3 Sites For Purchasing Instagram Followers

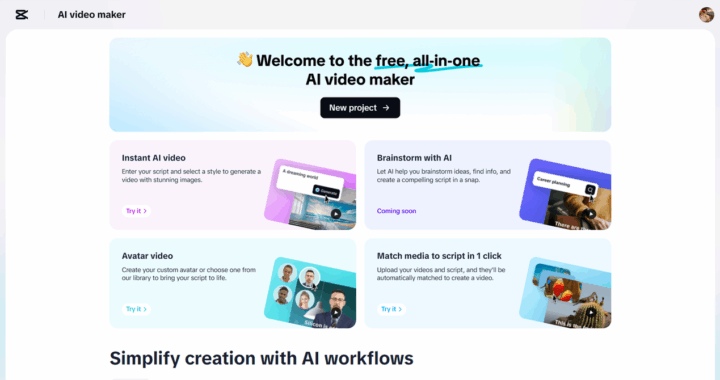

Ultimate 3 Sites For Purchasing Instagram Followers  Use AI Video Maker to Launch Seasonal Greetings That Wow

Use AI Video Maker to Launch Seasonal Greetings That Wow  How to Choose the Perfect Homecoming Dress

How to Choose the Perfect Homecoming Dress