Why Other Investors Are Interested In boAt

Are you looking for the ultimate audio experience? Then, we’ve got great news for you!

Warburg Pincus, a global private equity firm is in talks to acquire a significant stake in audio-tech company boAt. With this landmark move, music lovers can expect to enjoy an even more immersive audio experience.

So let’s dive into the details!

Introduction

Warburg Pincus, a global private equity firm with more than USD 54 billion in assets, is in talks with Indian lifestyle audio brand boAt to acquire a significant minority stake in the company. If a deal is successful, it will mark the latest non-bank financial institution to bet big on India’s growing ‘audio-wearable’ industry.

The transaction is expected to give boAt an enterprise value of around USD 200 million and provide it with much-needed funds as competition continues to increase in the booming industry. Founded in 2016 by three friends—Aman Gupta, Sameer Mehta and Rahul Sharm—boAt has become one of the most popular brands among India’s millennials thanks to its stylish range of audio accessories, apparel and other lifestyle items.

The potential investment from Warburg Pincus comes after boAt recently entered into 30 strategic partnerships with leading global advisory firms and technology giants such as Qualcomm Ventures to drive brand visibility and innovation. The company also continues to leverage its strong distribution network and online marketplaces like Amazon, Flipkart and Paytm Mall for product visibility.

Overview of Warburg Pincus

Warburg Pincus is a leading global private equity firm with offices in 14 cities across the globe. Founded in 1966, the firm has more than $44 billion in asset management and has invested billions of dollars in more than 750 companies across various industries and geographies.

Warburg Pincus works closely with its portfolio companies to provide strategic advice and analytics, financial capital, and connections to industry stakeholders. The firm typically focuses on business growth investments and has formed long-term partnerships with some of the most influential entrepreneurs, management teams, and leading governments worldwide.

Overview of boAt

BoAt, formerly known as Imagine Marketing Pvt Ltd., is an Indian consumer lifestyle brand that designs, manufactures and markets audio and lifestyle products. Headquartered in Delhi, the company was founded in 2016 by three friends – Aman Gupta, Sameer Mehta and Shamik Sharma. It has become one of India’s leading audio categories companies with a strong online and offline presence. BoAt caters to fashion conscious youth as its core target audience offering fashionable premium audio equipment like headphones, earphones and speakers.

Apart from retailing through major e-commerce platforms like Amazon, Flipkart and Paytm Mall; boAt also sells its products through multi-brand outlets across India including Reliance Digital, Croma and Vijay Sales. Furthermore the company has exclusive outlets in multiple cities such as Delhi NCR, Bangalore & Chennai with plans to expand further into Tier I cities like Mumbai & Kolkata. BoAt also retails through over 20K outlets worldwide in countries such as USA, United Kingdom (UK), Singapore & Russia, accounting for almost 10% of all sales globally.

Exclusive | Warburg Pincus in talks to acquire stake in boAt

Warburg Pincus, a New York City-based global investment firm, is in advanced negotiations to acquire a stake in India-based consumer electronics company boAt. The talks are in the final stages and expected to be concluded soon.

Warburg Pincus is expected to acquire a minority stake of around 8-10 percent in boAt for an estimated amount of Rs 500 crore. The investment firm tied up with boAt for the acquisition in April 2021, after talks broke down between the company and another potential investor around February 2021.

This investment is set to significantly expand boAt’s already large presence in India’s consumer electronics market. Currently, boAt holds 15 percent of India’s total audio accessories market share at Rs 3,500 crore. According to Counterpoint Research, it has a customer base of 17 million across 200 countries as of June 2020. This customer base has grown by over 500 percent since 2015 when Sameer Mehta and Aman Gupta founded the company.

This acquisition follows from boAt’s successful funding round which took place earlier this month where they received an additional $100 million, bringing their total funding to $128 million since their founding six years ago. With this investment and new funding round Warburg Pinicus looks set to become part of the burgeoning success story that is BoAt’s continuing growth trajectory into India’s booming consumer electronics market.

Benefits of the Acquisition

The acquisition of a stake in boAt by Warburg Pincus would bring several advantages and greatly boost the company. Firstly, the infusion of funds strengthens boAt’s financial position and allows for further expansion and development.

In addition, the partnership between boAt and Warburg Pincus would create many opportunities for both companies. This includes access to new customers, increased product range, further investments in research & development and improved marketing activities.

Furthermore, Warburg Pincus brings its extensive network of contacts that could prove beneficial in building strategic partnerships for boAt. The acquisition could also open up new markets for the company and help it achieve greater efficiency through technical know-how and expertise provided by Warburg Pincus.

Overall, this deal presents a massive opportunity to boost the presence of boAt while ensuring the sustainability of its products in an ever-evolving consumer market world-wide.

Potential Challenges

As one of the leading private equity firms in the world, Warburg Pincus is certainly well-versed with investments. However, with this potential venture comes some potential challenges.

First and foremost is competition from other large private equity funds in the market and other strategic investors who may also be looking to invest in Audioboom’s upcoming IPO. Intense competition could pressure Warburg Pincus to get a higher shareholder return or negotiate a better deal than it intended to acquire.

Additionally, investors should look at any potential legal or regulatory challenges that could arise during the transaction process. This includes regulations governing foreign direct investments, cybersecurity, taxation and intellectual property law that may all need to be addressed.

Finally, since boAt is an Indian company, there may be cultural differences between Warburg Pincus’ international office and local stakeholders which could lead to some unique challenges when making strategic decisions related to this investment. While not impossible to overcome, these challenges should not be ignored during the transaction process.

Future Prospects

Warburg Pincus, one of the world’s most respected private equity firms, is in talks to acquire a significant stake in boAt. According to sources close to the deal, the firm is looking to invest between $50 million to $80 million for a minority stake. In addition, the Singapore-based holding company Temasek and Los Angeles investment firm CDPQ are also rumored to be interested in potentially investing in boAt.

The acquisition would be a major win for boAt and could potentially see the company accelerate its growth through rapid expansion into new markets. The funds raised could also be used to expedite product development and strengthen their online and offline brand presence.

With Warburg Pincus on board as an investor, this could open more possibilities for strategic partnerships, potential collaborations with top global brands, and wider access to capital. It would also provide greater oversight on the financial management of boAt operations given Warburg’s vast experience managing complex financial investments across multiple industries worldwide.

In short, this move has huge potential for boAt as it will help them expand their operations and reach a wider demographic of consumers in different parts of world — something that have been struggling with recently due to stiff competition from other audio equipment manufacturers like JBL and Sony. It’ll be interesting what comes out from these talks between both companies!

Conclusion

Following the announcement of Warburg Pincus’ possible investment in boAt, investors and industry insiders are watching with great interest to gain further insights into the deal.

A successful acquisition of a stake in boAt could signify greater market consolidation in the personal audio sector, while providing boAt with greater resources to grow its product offerings and extend its international presence. It will also signal a validation of their business model and strong revenue growth that they have experienced recently.

The deal is yet to be confirmed but will likely occur shortly.

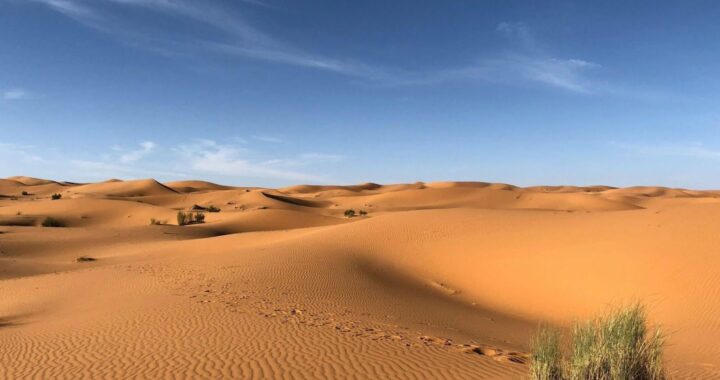

Why O General ACs are the Secret Weapon Against Desert Heat in the Middle East

Why O General ACs are the Secret Weapon Against Desert Heat in the Middle East  Why Marketers and Developers Prefer ISP Proxies Over Other Options

Why Marketers and Developers Prefer ISP Proxies Over Other Options  Are Oval Diamond Rings More Affordable Than Other Cuts?

Are Oval Diamond Rings More Affordable Than Other Cuts?